[ad_1]

LUNA price struggled to defend the critical support level extending the previous session losses. The recent price action is suggesting the sellers are in no mood to go away. Still, the sidelined investors might find some buying opportunity that could result in a relief rally.

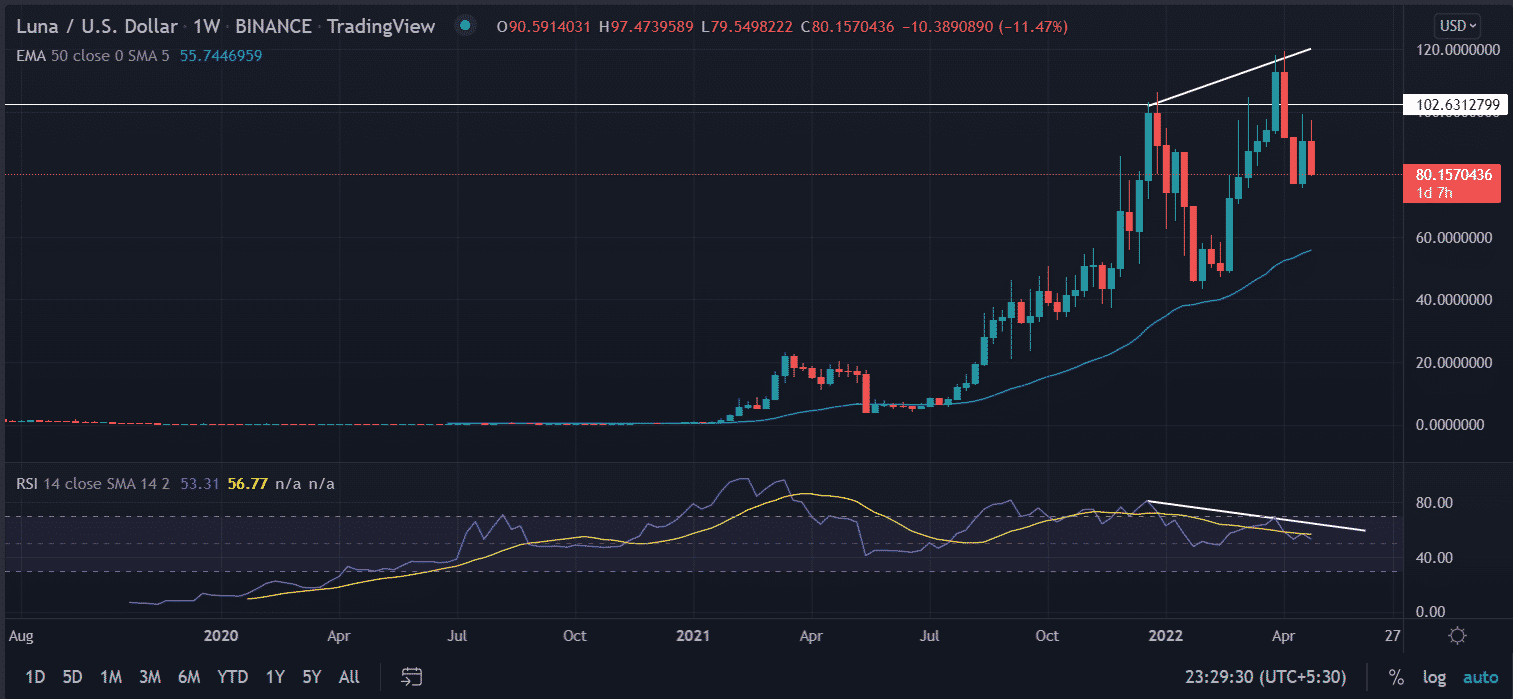

LUNA’s price has fallen below a support barrier at $80.0, indicating the beginning of a new downtrend.

As per the technical perspective, we expect the downside to continue and retest the weekly demand zone, extending from $72 to $60.

A decisive close above the 50-day EMA would challenge the bears on the daily basis.

As of publication time, LUNA/USD is exchanging hands at $79.65, down 5.97 % for the day. As per CoinMarketCap, the eight-largest cryptocurrency is holding at $1,524,048,081.

LUNA price reaffirms downside momentum

LUNA’s price witnessed a sharp correction from the record highs of $119.55 made in the April series. In the course of action, the price tested the swing lows of $75.77. The LUNA buyers attempted to make a bounce back but could not sustain the upside movement above $99.46. In addition to that sliced below the critical 50-day EMA (Exponential Moving Average) at $89.41.

Now, the price is dwindling near $80, a crucial level to hold by the buyers. If broken on a weekly basis would trigger another round of selling in the asset. In that case, the price will find a way toward the lows of February lows of $70.0 followed by $60.0

On the contrary, a spike in a buy order could threaten the prevailing trend. An immediate upside challenge would be found in the form of a 50-day ema at $90 on the daily chart.

Technical indicator

RSI: The weekly Relative Strength Index (RSI) gives a bearish divergence since December 20. This formation hints at the bearish momentum.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

[ad_2]

Source link

Be the first to comment